Don't miss his 'Outfox the Box' illustration. "Bill Schultheis has given readers something new: a book about index investing for people who like words and stories more than numbers and tables. This small-but-mighty volume is the perfect gift for loved ones looking to find their financial footing-and enrich their lives over their next coffee break." -CHRISTINE BENZ, Director of Personal Finance, Morningstar, Inc. His valuable message? Save, plan, and keep it simple, then get on with what really matters to you. PRAISE FOR THE COFFEEHOUSE INVESTOR'S GROUND RULES "Bill Schultheis approaches financial matters with so much wisdom and heart. In Millionaire Expat, he tailors his best advice to the unique needs of those living overseas to give you the targeted, real-world guidance you need. He knows how everyday people can achieve success in the market. Author Andrew Hallam was a high school teacher who built a million-dollar portfolio-on a teacher's salary.

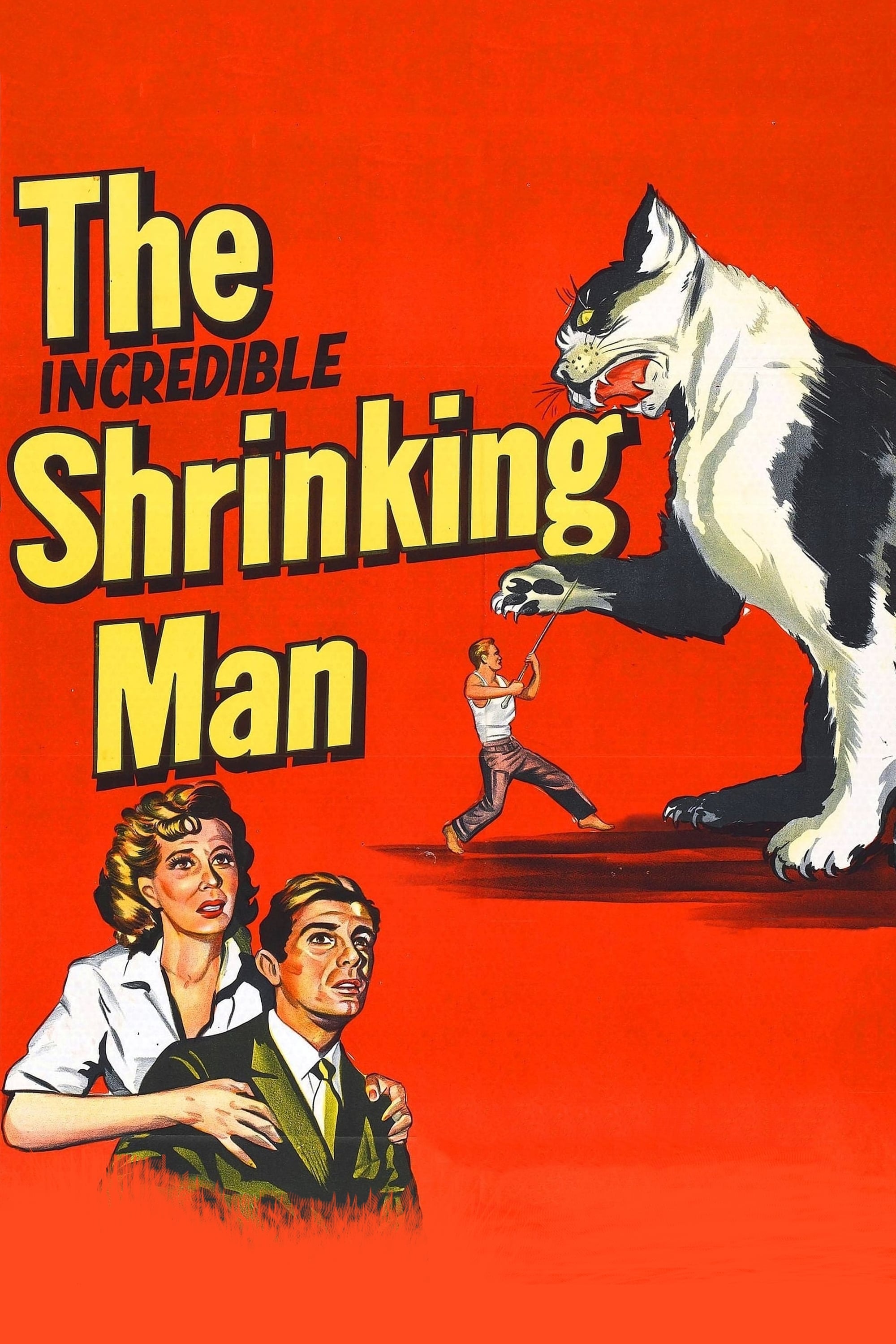

#The incredible shrinking alpha pdf how to#

Millionaire Expat (3rd edition) is an entertaining guide, showing readers how to maximize their money and their life satisfaction based on simple, smart investing and their choice of retirement destination. He explains what countries are great for Global Nomads and for retirees looking for tax breaks, safety, solid health care systems and a low-cost, enjoyable standard of living. He profiles several low-cost countries that are popular with expats. But what if you started investing late and can’t afford to retire? In that case, Andrew Hallam has you covered. And if you’re looking for a hands-free approach, Millionaire Expat offers something for you as well: lists of roboadvisors and full-service financial firms that offer guidance and build portfolios of ETFs and index funds. He explains how much you should sell each year, upon retirement, and discusses repatriation: showing how different countries deal with the taxation of portfolios that were built abroad. He shows you exactly what to buy and where to buy it from. Author Andrew Hallam doesn’t just offer theory. Millionaire Expat also provides investment models for socially responsible funds. It recommends subtle differences for investors based on nationality, while explaining why all-in-one portfolio funds are even simpler and more profitable than individual ETFs. This updated guide includes model portfolios of ETFs or index funds. It shows readers how to protect themselves from financial sharks and build effective portfolios that maximize profits and tax efficiency. The Incredible Shrinking Alpha 2nd editionīuild your strongest-ever portfolio from anywhere in the world Now in its third edition, Millionaire Expat is the world’s most trusted, bestselling guide for expat investors. This makes The Incredible Shrinking Alpha a complete guide to successful investment strategy. As a bonus they add appendices that will make you a more informed and, therefore, better investor. They present a list of vehicles to consider when implementing your plan and provide guidance on the care and maintenance of your portfolio. In this greatly expanded second edition, Swedroe and Berkin show you how to develop an investment plan that focuses on what risks to take, and how much of them, as well as how to build a diversified portfolio. They demonstrate that even for the most talented managers, their ability to add value is waning because: the amount of alpha available is declining it must be split among an increasing amount of investment dollars and the competition is getting tougher. Alpha, or outperformance against appropriate risk-adjusted benchmarks, is shrinking as it gets converted into beta, or factor exposures. If you don’t yet believe, Swedroe and Berkin provide a compelling case that you’re playing the loser’s game of active management. If you understand the benefits of indexing, or systematic investing, it will reinforce your commitment while increasing your knowledge. This comprehensive book is the antidote for the active managers’ siren song. Active managers persistently lag the returns of benchmarks and index funds that track them, with the excuses for underperformance recycled every year.

0 kommentar(er)

0 kommentar(er)